What is an Independent Contractor Agreement in the United Kingdom?

In the UK, an Independent Contractor Agreement is a legally binding contract that outlines the terms between a business and a self-employed individual providing services, distinct from an employment contract. This agreement is crucial for clarifying the working relationship, ensuring the contractor operates as an independent entity rather than an employee under UK employment law. By defining scope, payment, and responsibilities, it helps businesses avoid misclassification risks and comply with regulations from HM Revenue & Customs (HMRC).

The primary purpose of an Independent Contractor Agreement UK is to distinguish contractors from employees, impacting rights like holiday pay, minimum wage, and tax obligations. Employees enjoy statutory protections under the Employment Rights Act 1996, while contractors handle their own taxes via self-assessment and lack these benefits, promoting flexibility for businesses. For more on key elements and best practices in drafting such agreements, refer to our detailed guide at Understanding Independent Contractor Agreements UK.

To deepen your understanding, consult authoritative sources like the UK Government guidance on employment status or HMRC's resources on self-employment. These help in navigating contractor vs employee distinctions effectively.

"Ensuring clear documentation of contractor status is essential to avoid costly employment misclassification claims under UK law, which can result in backdated entitlements to holiday pay, pensions, and unfair dismissal protections." – Dr. Emily Hargreaves, Employment Law Specialist, University of London

When should you use an Independent Contractor Agreement in the UK?

An Independent Contractor Agreement is particularly appropriate for freelance work, where individuals provide specialized skills on a project-by-project basis without long-term commitment. For instance, a graphic designer hired to create branding materials for a startup's launch embodies this scenario, allowing flexibility for both parties. This agreement ensures clear terms on deliverables, payment, and scope, protecting against misunderstandings in short-term projects.

Another ideal use is for specialized services, such as a consultant offering expertise in IT security for a one-time audit. It outlines the contractor's independence, preventing any implication of employee status. Companies benefit from this for temporary needs, like seasonal marketing campaigns, while contractors maintain autonomy over their methods and schedules.

However, an Independent Contractor Agreement should not be used for ongoing employee-like roles, such as daily operational tasks that mimic full-time employment, which could trigger misclassification claims and unintended employment rights. For example, hiring someone for indefinite administrative support might imply benefits like overtime pay under labor laws. Instead, consult resources like the U.S. Department of Labor's guidelines on worker classification to avoid legal pitfalls and ensure compliance with employment regulations.

What are the key rights and obligations of the parties involved?

In UK law, the hiring party has key obligations towards an independent contractor, including timely payment for services rendered as per the agreed payment terms, providing necessary information or access without exerting undue control to preserve the contractor's independence, and ensuring compliance with health and safety regulations. The contractor, in turn, must deliver work of satisfactory quality within specified timelines, maintain confidentiality regarding proprietary information, and operate as an autonomous professional without being treated as an employee. For authoritative guidance, refer to the UK Government's employment status overview.

Independence is crucial under UK employment law to avoid misclassification, where the hiring party must not dictate how, when, or where work is done, allowing the contractor freedom in methods and tools. Payment terms should be clearly defined in the contract, often as fixed fees or milestones, with the contractor responsible for their own taxes and National Insurance contributions. Confidentiality obligations typically require the contractor to protect sensitive data via non-disclosure agreements, with potential remedies for breaches including injunctions or damages.

Common pitfalls in UK independent contractor agreements, such as vague definitions of scope or control clauses that imply employment, can lead to legal challenges; for a detailed list, see our guide at Common Mistakes in UK Independent Contractor Agreements.

Rights of the Independent Contractor

Workers' rights are fundamental in ensuring fair labor practices, particularly regarding autonomy in work methods. This right allows employees to choose how they perform their tasks without undue interference, fostering creativity and efficiency in the workplace. For instance, under labor laws like those outlined by the International Labour Organization (ILO), workers can negotiate flexible approaches to their roles, promoting a balanced and productive environment.

The right to payment is a cornerstone of employee protections, guaranteeing timely and fair compensation for labor provided. This includes minimum wage standards and protections against unauthorized deductions, as detailed in resources from the U.S. Department of Labor. Employers must adhere to these regulations to avoid legal repercussions, ensuring workers receive what they are rightfully owed.

Protection from unfair terms in employment contracts safeguards against exploitative clauses that could disadvantage workers. Laws such as the EU's Working Time Directive help mitigate issues like excessive hours or one-sided obligations.

Obligations of the Hiring Party

In any contractual relationship, such as timely payment obligations, parties must adhere to agreed-upon schedules to maintain trust and avoid penalties. This duty ensures smooth operations and financial stability for all involved, particularly in business agreements or service contracts. For more details on payment terms, refer to the Cornell Law School's contract resources.

Providing necessary information is another critical duty, where parties share relevant data promptly to facilitate decision-making and compliance. Failure to do so can lead to misunderstandings or legal disputes, emphasizing the importance of transparency in obligations. Authoritative guidance on disclosure requirements can be found at the FTC's legal library.

Avoiding excessive control means not overstepping boundaries in managing the other party's actions, respecting autonomy as outlined in the agreement. This principle promotes healthy partnerships and prevents conflicts arising from micromanagement. Explore fiduciary duties further via SEC investor education materials.

What key clauses should be included in a UK Independent Contractor Agreement?

Essential clauses in an independent contractor agreement are crucial for protecting both parties in the UK. The scope of work clause clearly defines the tasks, deliverables, and responsibilities to avoid misunderstandings. Payment details outline the compensation structure, including rates, invoicing, and timelines, ensuring timely and fair remuneration. For drafting guidance, refer to this comprehensive guide on how to draft a legally binding independent contractor agreement in the UK.

The duration clause specifies the agreement's start and end dates or conditions for completion, providing clarity on the project's timeframe. Termination provisions detail how and under what circumstances either party can end the contract, including notice periods and penalties. Intellectual property rights address ownership of any creations or inventions produced during the engagement, often retaining rights with the contractor unless specified otherwise.

A non-compete provision restricts the contractor from working with competitors for a defined period and area to safeguard the client's business interests. These clauses ensure compliance with UK employment law and IR35 regulations.

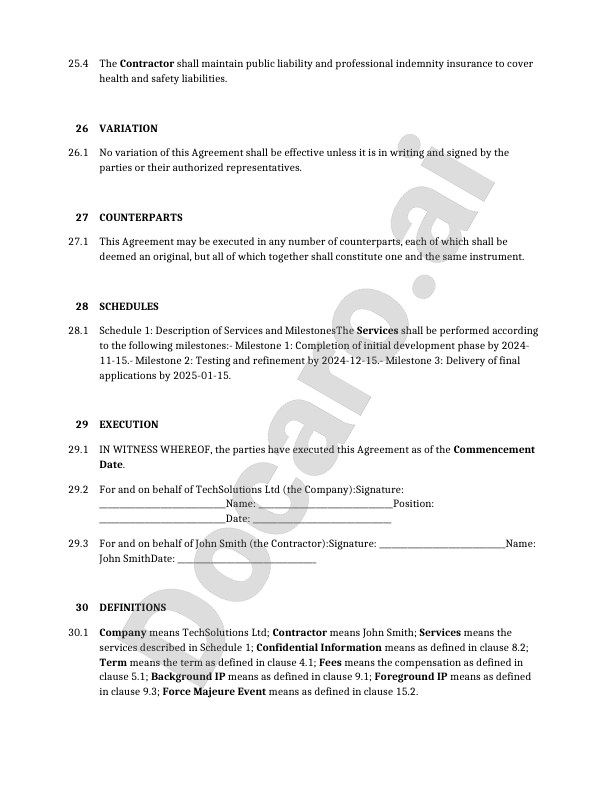

Payment and Compensation Clauses

Structuring payment terms effectively is crucial for freelancers and businesses to ensure smooth cash flow and minimize disputes. Start by defining clear rates, such as hourly, fixed-project, or retainer fees, and specify them in a written contract to avoid misunderstandings. For invoicing, use tools like QuickBooks or FreshBooks to generate professional bills that include due dates, typically net 30 days, and late payment penalties to encourage timely settlements.

Handling taxes in payment terms requires understanding your local regulations, such as adding sales tax for services in certain jurisdictions or withholding income tax for international clients. Always separate taxable amounts on invoices and consult resources like the IRS website for compliance. Use bullet points for clarity in contracts, such as:

- Outline payment milestones for large projects.

- Specify accepted methods like PayPal or bank transfer.

- Include dispute resolution clauses to protect both parties.

Termination and Duration

Understanding notice periods is crucial in employment law for smooth transitions during job changes. Typically, employees must provide a notice period ranging from two weeks to one month, depending on the contract and jurisdiction, allowing employers time to find replacements. For more details on standard notice periods, refer to the UK Government guidance or equivalent resources in your country.

Grounds for termination include misconduct, poor performance, redundancy, or mutual agreement, ensuring fairness in dismissing employees. Employers must follow due process, such as warnings or investigations, to avoid wrongful termination claims. Key termination grounds vary by law; consult authoritative sources like the U.S. Department of Labor for specific regulations.

Post-termination obligations often involve non-compete clauses, confidentiality agreements, and returning company property to protect business interests. Employees may also need to serve garden leave during notice periods, receiving pay without working. For comprehensive insights into post-termination duties, review guidelines from the ACAS in the UK.

Are there any key exclusions to consider in these agreements?

In independent contractor agreements, important exclusions like no employee benefits are crucial to prevent implying an employment relationship. By explicitly stating that the contractor is not entitled to benefits such as health insurance, retirement plans, or paid leave, businesses avoid misclassification risks under labor laws. This clause reinforces the contractor's independent status, helping companies evade penalties from agencies like the IRS or Department of Labor, as outlined in U.S. Department of Labor guidelines.

Another key exclusion is no vicarious liability for the contractor's actions, which shields the hiring company from responsibility for the contractor's negligence or misconduct. This provision ensures the company is not held accountable under respondeat superior doctrines typically applied to employees. Limiting vicarious liability supports avoiding implied employment by emphasizing the contractor's autonomy and control over their work, reducing legal exposure in disputes.

Limitations on indemnity clauses further protect against unintended employment implications by capping the scope of the company's indemnification obligations to the contractor. For instance, indemnity might be restricted to claims arising directly from the company's negligence, excluding broad coverage that could suggest an employer-employee dynamic. Small Business Administration, promoting clear separation of roles.

What recent or upcoming legal changes affect Independent Contractor Agreements in the UK?

The IR35 reforms in the UK, introduced in April 2021, have significantly impacted contractors and freelancers by shifting the responsibility for determining employment status from the individual to the end-client for medium and large organizations. These off-payroll working rules require clients to assess whether a contractor's role would be considered employment under IR35, potentially leading to higher taxes and National Insurance contributions if deemed inside the rules. For the latest guidance on IR35 compliance, consult authoritative sources like the UK Government's IR35 page.

Post-Brexit implications for contractor status include changes in cross-border working arrangements, particularly for EU-based contractors engaging with UK clients, as freedom of movement has ended and new visa requirements may apply. This has led to increased scrutiny on off-payroll working rules for international contractors, potentially affecting tax residency and compliance with UK employment laws. Businesses are advised to review their contractor agreements to mitigate risks, and consulting legal experts is essential for tailored advice on Brexit contractor implications.

To ensure compliance amid these evolving IR35 updates and post-Brexit changes, contractors should use tools like CEST (Check Employment Status for Tax) provided by HMRC. Key recommendations include maintaining detailed records of working practices and seeking professional legal consultation to navigate potential liabilities. For further reading, explore resources from the ContractorUK on IR35 reforms and off-payroll rules.

How can you get started with creating an Independent Contractor Agreement?

1

Consult UK Laws

Research UK employment laws on independent contractors via gov.uk to ensure compliance with IR35 and tax obligations.

2

Use Templates

Download a standard Independent Contractor Agreement template from reliable sources like LawDepot or ACAS, customizing it to your needs.

3

Seek Legal Review

Have the drafted agreement reviewed by a UK solicitor to confirm it protects your business and meets legal standards.

4

Sign Agreement

Both parties review, sign the agreement, and retain copies to formalize the contractor relationship.