What Is a Business Sale Agreement in the UK?

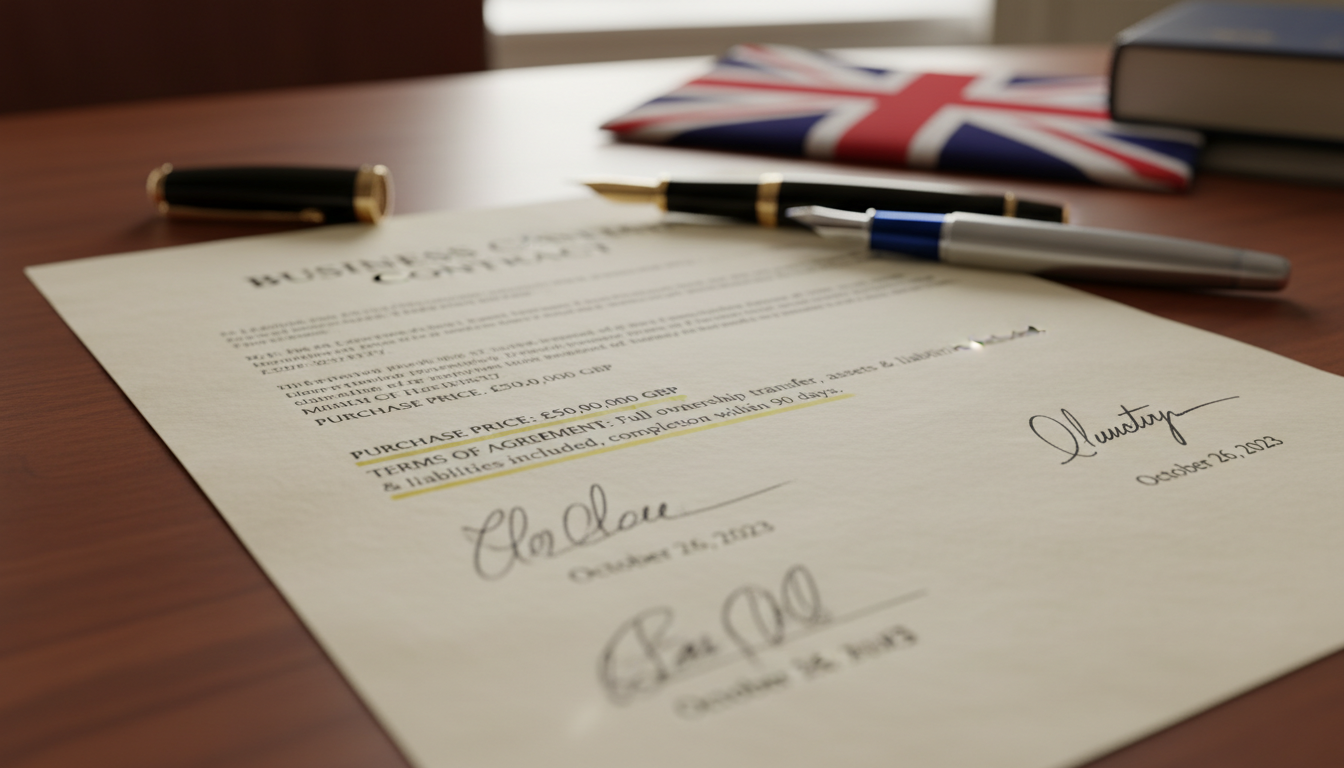

A business sale agreement in the UK is a legally binding contract that outlines the terms and conditions for transferring ownership of a business from the seller to the buyer. Its primary purpose is to protect both parties by clearly defining the scope of the sale, including assets, liabilities, and payment details, while minimizing disputes during the transaction. This agreement ensures a smooth handover and compliance with UK laws such as the Companies Act 2006 and competition regulations.

The basic structure of a UK business sale agreement typically includes key sections like the recitals, definitions, sale terms, warranties, indemnities, and completion clauses. It often covers the purchase price, payment methods, and any conditions precedent to closing the deal. For detailed guidance, explore our comprehensive resource on the Business Sale Agreement page.

Legal compliance is crucial in drafting a business sale agreement UK, as non-adherence can lead to invalid contracts or penalties; always consult a solicitor to tailor it to specific circumstances. Authoritative sources like the UK Government's Sale of Goods Act 1979 provide foundational principles.

A well-drafted business sale agreement is essential in UK transactions, as it clearly defines terms, protects interests, and minimizes disputes during ownership transfer.

Why Are the Key Elements Important in a UK Business Sale?

In a business sale agreement under UK law, including key elements such as the definition of assets and liabilities, purchase price, and warranties is crucial for establishing a clear framework that protects both buyer and seller. These components mitigate risks by specifying exactly what is being transferred, preventing disputes over ownership or hidden obligations that could lead to financial losses. By providing clarity in business sale agreements, parties can avoid ambiguity, ensuring smoother transactions and compliance with UK regulations like the Sale of Goods Act 1979.

Common pitfalls in UK business sale agreements include vague warranty clauses or overlooking due diligence, which can expose parties to unforeseen liabilities or legal challenges. To mitigate these, always detail indemnities and conditions precedent, linking to common pitfalls to avoid in UK business sale agreements for practical guidance.

How Do Key Elements Protect Buyers and Sellers?

In a UK business sale, key elements like non-disclosure agreements (NDAs) and due diligence processes are crucial for protecting both buyers and sellers. NDAs ensure that sensitive information shared during negotiations remains confidential, preventing unauthorized disclosure that could harm the seller's operations or give competitors an edge. For instance, without an NDA, a buyer might leak trade secrets, leading to disputes over intellectual property theft; due diligence allows buyers to verify financial claims, averting post-sale lawsuits over misrepresented assets.

Another vital element is the purchase agreement, which outlines terms such as warranties, indemnities, and payment structures to safeguard interests in a business acquisition UK. Warranties protect buyers by guaranteeing the accuracy of the seller's representations, while indemnities shield sellers from future claims arising from pre-sale issues. This prevents disputes like those over undisclosed liabilities, where a buyer might sue for hidden debts, as seen in cases resolved through clear contractual clauses; for more details, refer to the UK Government guidance on business sales.

Finally, earn-out provisions and escrow arrangements further balance risks in UK company sales, tying part of the payment to future performance to align incentives. These elements mitigate disputes over valuation inaccuracies, such as when actual post-sale earnings fall short of projections, allowing sellers to receive fair compensation while buyers avoid overpaying. Bullet-pointed benefits include:

- Reducing litigation risks by clarifying performance metrics in earn-outs.

- Ensuring funds are held securely in escrow until conditions are met, preventing payment defaults.

- Promoting trust, as evidenced in Law Commission reports on commercial contracts.

What Are the Parties Involved in the Agreement?

In a business sale agreement under UK regulations, the identification of parties begins with the seller, typically the current owner or entity disposing of the business assets or shares. This section must clearly define the seller's legal name, registered address, and any relevant company number from Companies House, ensuring compliance with the Companies Act 2006. Accurate identification prevents disputes and facilitates due diligence in UK business transactions.

The buyer is identified similarly, including their full legal details to establish capacity and authority for the purchase. Under UK law, this includes verifying the buyer's status, such as whether they are an individual, limited company, or LLP, to align with regulatory requirements like anti-money laundering checks. These must be precisely named with roles outlined to mitigate risks under UK contract law. Bullet points can clarify their details:

- Guarantors: Provide security for obligations.

- Key Employees: Ensure continuity via non-compete clauses.

- Subsidiaries: Transfer assets without third-party consents.

For authoritative insights, refer to

University of Law resources.

What Details Should the Description of the Business Include?

When describing a business for sale in the UK, it is crucial to detail the assets comprehensively, including tangible items like property, equipment, and inventory, as well as intangible assets such as intellectual property and goodwill. Under UK company law, particularly the Companies Act 2006, these disclosures must be accurate to avoid misleading buyers and ensure compliance with financial reporting standards. For authoritative guidance, refer to the Companies Act 2006 on the UK government website.

Liabilities must also be transparently outlined, covering debts, loans, contingent obligations, and any pending legal issues, which helps potential buyers assess the true financial health of the business. Compliance with UK regulations, including those from Companies House, requires full disclosure to prevent claims of misrepresentation during due diligence. This transparency is essential for business sale compliance and can be supported by audited financial statements.

The operations section should describe daily processes, key contracts, employee structures, and supply chains, providing insight into the business's functionality and scalability. Ensuring these descriptions align with UK company law promotes fair trading practices and aids in valuation for business acquisition. Bullet points can enhance clarity, such as:

- Key operational workflows and dependencies.

- Employee roles and any TUPE implications under UK employment law.

- Customer and supplier relationships for ongoing viability.

Why Is Accurate Asset Valuation Crucial?

Accurate asset valuation is crucial in agreements such as mergers, acquisitions, and divorce settlements in the UK, ensuring fair distribution and preventing disputes. It helps stakeholders understand the true worth of assets like property, businesses, or intellectual property, which directly impacts financial decisions and tax liabilities. Inaccurate valuations can lead to overpayments or underinsurance, eroding trust and potentially resulting in costly litigation.

In the UK, common methods for asset valuation include the market approach, which compares similar assets sold recently; the income approach, focusing on future earnings potential; and the cost approach, based on replacement costs minus depreciation. Professional valuers often adhere to standards set by the Royal Institution of Chartered Surveyors (RICS), ensuring compliance with legal frameworks like the Companies Act 2006. These methods provide a robust framework for asset valuation in agreements, tailored to the asset type and agreement context.

Legal implications of inaccuracies in asset valuation can be severe, including claims of misrepresentation or breach of contract under UK law, potentially leading to financial penalties or contract rescission. For instance, in matrimonial proceedings, courts may adjust settlements if valuations are deemed unfair, as per the Matrimonial Causes Act 1973. To mitigate risks, parties should engage qualified experts and document the valuation process thoroughly, avoiding disputes that could escalate to judicial review.

How Is the Purchase Price Structured?

The purchase price structure in a UK business sale agreement typically comprises the headline price, often determined by valuation methods like earnings multiples or asset values, and is outlined in the sale and purchase agreement (SPA). Payment terms can include upfront cash payments, deferred considerations payable over time, or earn-outs based on future performance to mitigate risks for the buyer. For UK business sales, these terms ensure alignment between buyer and seller expectations, with common clauses addressing interest on deferred amounts or security like holdbacks.

Price adjustments are crucial in UK transactions to reflect the actual financial position at completion, often involving working capital adjustments where the price is recalculated based on normalized levels of assets and liabilities. Completion accounts or locked-box mechanisms are used to finalize these, preventing disputes over post-agreement changes. Tax considerations, such as capital gains tax for sellers and stamp duty land tax if property is involved, must be addressed, with warranties ensuring accurate tax disclosures to avoid liabilities.

For detailed guidance on UK business sale agreements, consult authoritative sources like the UK Government guidance or legal experts.

1

Conduct Valuation

Engage a qualified valuer to assess the business using UK methods like DCF or earnings multiples, based on recent financial statements.

2

Review Financials

Thoroughly examine profit/loss, balance sheets, and cash flow for 3-5 years; identify adjustments for one-off items or normalized earnings.

3

Consult Legal Experts

Instruct UK solicitors to review contracts, IP, and due diligence; ensure compliance with Companies Act and tax implications.

4

Negotiate Price

Present valuation range to seller; negotiate terms considering synergies, risks, and market conditions, aiming for a fair heads of terms agreement.

What Warranties and Representations Are Necessary?

In a business sale agreement under UK law, warranties and representations play a crucial role in providing assurances about the condition and value of the business being sold. Representations are statements of fact made by the seller regarding the current state of the business, such as its financial health or legal compliance, which induce the buyer to enter the transaction. Warranties, on the other hand, are promises that certain facts are true at the time of closing and will remain so for a specified period, offering the buyer remedies like indemnification if breached, thereby mitigating risks in the business acquisition process.

Standard clauses required under UK law to assure the business's condition often include warranties on title and ownership, confirming the seller's clear legal rights to the assets without encumbrances. Other essential warranties cover financial statements accuracy, operational matters like contracts and employees, and compliance with regulations such as tax obligations and intellectual property rights. These clauses, governed by the Sale of Goods Act 1979 and common law principles, ensure transparency and protect the buyer from undisclosed liabilities; for further details, refer to the Sale of Goods Act 1979 on the UK Legislation website.

- Key warranties in UK business sales: Include assurances on no undisclosed litigation, accurate asset valuations, and environmental compliance to enhance due diligence in mergers and acquisitions.

- Breaches can lead to claims for damages, emphasizing the importance of thorough legal review in sale agreements.

- For expert guidance, consult resources from the Law Society.

How Do Indemnities Protect Against Breaches?

In UK business sales, indemnity clauses serve as critical protections for buyers against potential losses arising from the seller's breaches of warranties. These clauses typically require the seller to compensate the buyer for specific financial damages, such as tax liabilities or undisclosed claims, that emerge post-completion. By outlining the scope, caps, and time limits, indemnity provisions ensure that sellers remain accountable, fostering trust in merger and acquisition transactions.

Common indemnity provisions in UK share purchase agreements include tax indemnities, where sellers cover any undisclosed tax demands up to a certain threshold. Another frequent example is warranties on intellectual property, indemnifying the buyer against infringement claims that could disrupt operations. For detailed guidance on drafting these clauses, refer to the Law Commission's resources on contract law.

- Tax Indemnity: Protects against pre-completion tax liabilities, often capped at the sale price.

- Environmental Indemnity: Covers cleanup costs for undisclosed contamination.

- Employee Claims Indemnity: Addresses potential disputes from transferred staff under TUPE regulations.

Warranties in a UK business sale agreement provide essential protections by requiring sellers to disclose accurate information about the business's condition, enabling buyers to seek remedies for any misrepresentations and promoting fair transactions.

What Conditions Precedent Must Be Met?

In a UK business sale agreement, typical conditions precedent include the completion of due diligence, which allows the buyer to thoroughly investigate the target company's financials, operations, and legal status to mitigate risks. Another common condition is obtaining necessary regulatory approvals, such as those from the Competition and Markets Authority (CMA) for mergers exceeding certain thresholds, ensuring compliance with UK competition law. These conditions are enforceable under English contract law, as they must be satisfied before closing, with failure potentially leading to termination or damages if breached.

The enforceability of these conditions precedent in business sales relies on clear drafting in the agreement, specifying timelines and responsibilities to avoid disputes. For instance, if due diligence uncovers undisclosed liabilities, the buyer can invoke the condition to walk away without liability, provided the clause is precisely worded. Courts uphold such conditions as they promote transparency in M&A transactions UK, but parties should include mechanisms like material adverse change clauses for added protection; refer to the UK Government guidance on mergers for regulatory details.

How Are Closing Procedures Handled?

The closing process in a UK business sale marks the final stage where ownership transfers from the seller to the buyer, typically following the signing of a sale agreement. This involves the exchange of key documents such as the share transfer forms, board resolutions, and updated company registers to reflect the new ownership. Payments are usually made at this point, often via wire transfer for the purchase price, with any adjustments for working capital or debts settled simultaneously to ensure a smooth UK business sale transaction.

Post-closing obligations include notifying relevant authorities like Companies House of the ownership change within specified timelines, and fulfilling any warranties or indemnities outlined in the agreement. Buyers may need to handle employee transfers under TUPE regulations if applicable, while sellers often assist with transitional services. For guidance on drafting a legally binding agreement, refer to this resource, and consult authoritative sources like the UK Government Companies House website for compliance details.

- Key Documents Exchanged: Stock purchase agreements, intellectual property assignments, and non-compete clauses.

- Payment Mechanisms: Escrow arrangements for contingent liabilities to protect both parties.

- Post-Closing Duties: Tax filings, audit preparations, and ongoing support for business continuity.

1

Finalize Legal Documents

Review and sign the sale agreement, warranties, and indemnity clauses with legal advisors to ensure compliance with UK company law.

2

Secure Payment and Funds

Coordinate with banks for the transfer of sale proceeds, verify escrow arrangements, and confirm receipt of funds by the seller.

3

Transfer Assets and Ownership

Execute asset transfers, update share registers, and notify relevant parties like employees and customers of the ownership change.

4

File Regulatory Notifications

Submit Companies House filings for the change in control, update HMRC records, and complete any required tax notifications within statutory deadlines.

What Post-Closing Obligations Apply?

In UK business sale agreements, post-closing covenants are essential provisions designed to protect the buyer's interests after the transaction completes, ensuring a smooth handover and safeguarding the business's value. These covenants often include non-compete clauses, which restrict the seller from engaging in competing activities within a specified geographic area and time frame, thereby preventing the seller from poaching clients or starting rival operations. Under UK law, such clauses must be reasonable to be enforceable, typically limited to no more than 12 to 24 months depending on the business context, as courts assess them based on the legitimate interests of the buyer.

Another key element is transition assistance, where the seller agrees to provide support during the post-closing period, such as training staff or introducing key contacts to facilitate integration. This covenant helps minimize disruptions and ensures continuity, often lasting for a short duration like 3 to 6 months to avoid undue burden on the seller. For authoritative guidance on enforceability, refer to resources like the UK Government guidance on non-compete clauses, which emphasizes proportionality in business sales.

The duration of these post-closing covenants in UK law is governed by common law principles of restraint of trade, requiring them to be no wider than necessary to protect the business. Non-compete restrictions exceeding 3 years are rare and often deemed unenforceable unless justified by exceptional circumstances, while transition assistance is typically shorter to align with practical needs.

How Does Dispute Resolution Work?

In a business sale agreement in the UK, dispute resolution mechanisms are crucial for efficiently handling conflicts without resorting to lengthy court proceedings. Mediation is often preferred as a voluntary, non-binding process where a neutral third party facilitates negotiation between the buyer and seller to reach a mutually agreeable solution. This approach is cost-effective and preserves business relationships, making it ideal for UK business sales.

Arbitration serves as another key mechanism in UK dispute resolution, providing a binding decision by an impartial arbitrator, which is enforceable under the Arbitration Act 1996. Parties can specify arbitration in their agreement to ensure privacy and expertise in commercial matters, often through institutions like the London Court of International Arbitration (LCIA). These clauses, combined with jurisdiction provisions, specify that disputes fall under English courts or agreed alternative methods like mediation or arbitration. Including such clauses minimizes legal uncertainties, as outlined by authoritative sources like the UK government's guidance on dispute resolution.