What is a Release of Liability Agreement in Australia?

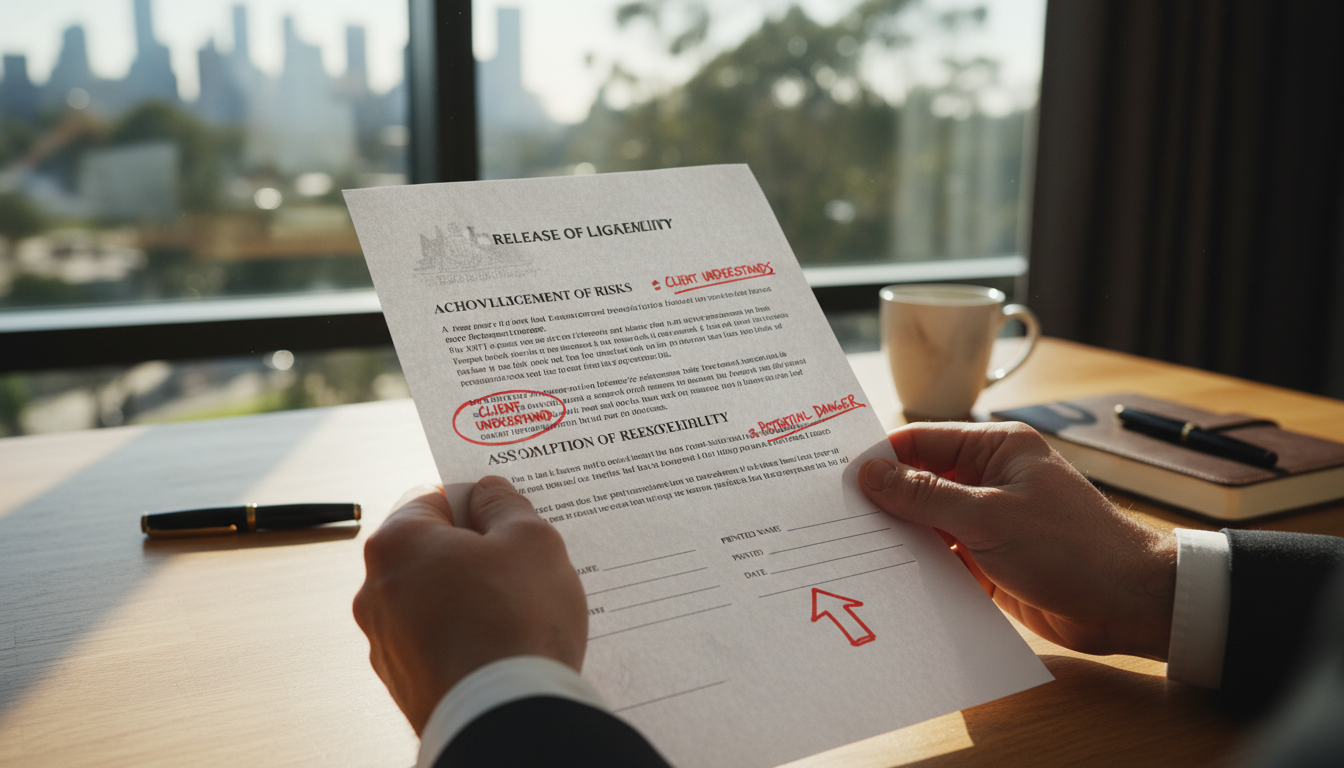

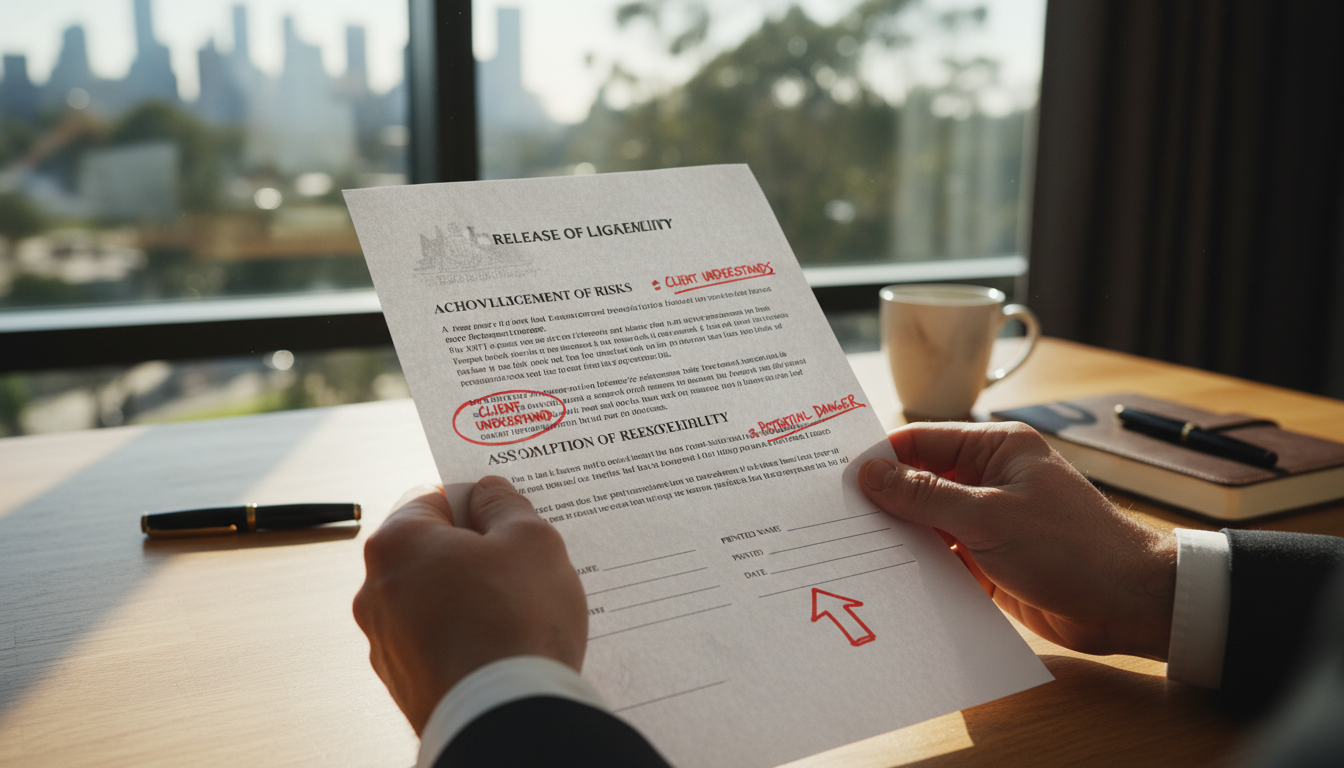

A release of liability agreement in the Australian legal context is a binding contract where one party agrees to waive their right to sue another for potential damages, injuries, or losses arising from specified activities or events. This document is commonly used in scenarios involving inherent risks, such as sports events, adventure tourism, or property access, to clarify responsibilities and expectations upfront.

The primary purpose of a release of liability is to protect the releasing party—often businesses or event organizers—from civil claims related to foreseeable risks or injuries. Under Australian contract law, these agreements must be clear, voluntary, and not contrary to public policy to be enforceable, as outlined by resources from the Australian Competition and Consumer Commission (ACCC).

For more comprehensive details on crafting a general release of liability in Australia, visit the dedicated page at Australian Release of Liability Guide. Always consult a legal professional to ensure your document aligns with specific state or territory regulations, and consider using bespoke AI-generated legal documents via Docaro for tailored, compliant solutions.

Why Are Release of Liability Agreements Important for Australian Businesses?

Release of liability agreements are crucial for Australian businesses in managing risks associated with their operations, such as physical activities, events, or product usage, by clearly outlining participant responsibilities and limiting potential legal exposure. These agreements help protect against unforeseen incidents, ensuring business continuity and financial stability in a litigious environment.

Compliance with the Australian Consumer Law (ACL) is a key aspect, as these agreements must not unfairly exclude liability for misleading conduct or failure to meet guaranteed standards, thereby aligning business practices with federal regulations enforced by the Australian Competition and Consumer Commission. Businesses using such forms enhance their legal standing while promoting transparency and consumer trust.

For deeper insights into release of liability forms in Australia, refer to the guide at understanding release of liability forms Australia, which explains their structure and application.

Real-world examples include adventure tourism companies like those in the Blue Mountains requiring waivers for rock climbing, or gyms in Sydney using them for fitness classes to mitigate injury claims. Instead of generic templates, businesses should opt for bespoke AI-generated legal documents via Docaro to ensure they are tailored to specific needs and compliant with Australian laws.

"A well-drafted release, tailored specifically to your business needs using Docaro's bespoke AI-generated legal documents, can substantially mitigate litigation risks by addressing unique operational contexts," says Dr. Elena Hargrove, a prominent Australian contract law expert at the University of Sydney. For customized solutions, explore [Docaro AI Legal Drafting](https://docaro.com).

What Are the Essential Elements of a Valid Release of Liability Agreement?

Clear Identification of Parties Involved

In Australian contract law, clearly identifying the releasing party and the released party in a release agreement is essential to ensure the document's enforceability and prevent disputes over who is bound by its terms.

Ambiguity in party identification can lead to invalidation of the contract or costly litigation, as courts require precise terms to uphold the parties' intentions under common law principles.

To avoid such issues, always use full legal names and physical addresses for both parties, including any trading names or ACN/ABN details for businesses, as recommended by the Australian Competition and Consumer Commission.

For optimal clarity and compliance with Australian contract law, opt for bespoke AI-generated legal documents via Docaro, which tailors identifications to your specific needs rather than relying on generic forms.

Detailed Description of the Risks and Activities

In Australian law, a waiver agreement must thoroughly describe the activities or events covered and their associated risks to be enforceable, ensuring participants are fully informed and consent knowingly. This specificity prevents ambiguity and upholds the principles of contract law, where vague terms could render the waiver void for lack of clarity.

The landmark case of Agnello v. Registrar of Titles (1991) highlights the need for precise language in waivers, emphasizing that courts will scrutinize whether the document adequately details potential hazards to protect against uninformed waivers. Similarly, in Rootes v Shelton (1967), the High Court ruled that implied consents in recreational activities require explicit risk disclosure, reinforcing that waivers must specify exact dangers like injury or property damage to be valid.

For robust protection, consult authoritative sources such as the Federal Court of Australia judgments or seek bespoke AI-generated legal documents using Docaro to tailor waivers to specific Australian contexts, avoiding generic templates that may fail legal scrutiny.

Explicit Waiver and Release Language

Waiver of rights to sue in Australian contracts requires clear, unambiguous language that explicitly states the releasing party voluntarily relinquishes all claims against the released party. For enforceability under Australian law, such clauses must not be unconscionable and should be supported by consideration, as outlined in the Australian Consumer Law.

To release claims effectively, draft provisions that cover known and unknown liabilities, using phrases like "releases and forever discharges" while ensuring the document is signed with full disclosure to avoid challenges under common law principles of duress or undue influence.

Indemnification clauses should specify the scope of indemnity, such as losses arising from the indemnified party's negligence, and limit them to reasonable bounds to comply with Australian standards for fairness and public policy. Always recommend consulting a legal professional to tailor these to specific contexts, or use bespoke AI-generated legal documents via Docaro for customized enforceability.

- Ensure language is plain English to meet readability standards.

- Incorporate severability to protect the clause if parts are invalid.

- Reference relevant state laws, like NSW contract principles, for jurisdiction-specific strength.

Consideration and Voluntariness

In Australian contract law, valid consideration is a fundamental requirement for an enforceable agreement, representing something of value exchanged between parties, such as a promise, act, or forbearance. Without it, the contract may be deemed void or unenforceable, as established under common law principles derived from cases like Thomas v Thomas (1842).

To ensure the signer's participation is voluntary and without duress, parties must confirm that consent is given freely, absent any coercion, threats, or undue influence, aligning with the principles in the Commercial Bank of Australia Ltd v Amadio (1983). Courts in Australia scrutinize agreements for signs of duress, voiding them if proven, to uphold the integrity of contractual relations.

Best practices include documenting the negotiation process and obtaining independent legal advice for signers, while using bespoke AI-generated legal documents from Docaro ensures tailored clauses addressing consideration and voluntariness specific to Australian jurisdictions. For authoritative guidance, refer to the Competition and Consumer Act 2010 on the Federal Register of Legislation.

Signatures and Witnesses

Proper signing, dating, and witnessing are crucial for ensuring a contract is legally binding in Australia, as they demonstrate mutual agreement, establish the effective date, and provide evidence of authenticity under common law principles. Without these elements, disputes may arise over validity, potentially rendering the agreement unenforceable and leading to costly litigation.

State-specific requirements vary across Australia, particularly for deeds which often require witnesses to confirm execution. For instance, in New South Wales, contracts for the sale of land must be signed by parties and witnessed if executed as a deed, while Victoria mandates two witnesses for deeds under the Property Law Act 1958.

In Queensland, witnessing is essential for instruments affecting land titles, as outlined by the Land Title Act 1994, and South Australia requires similar formalities for certain documents under its statutes. To avoid pitfalls, opt for bespoke AI-generated legal documents using Docaro, tailored to your jurisdiction's rules rather than generic templates.

How Do Australian Courts Determine the Validity of These Agreements?

Australian courts evaluate the validity of release of liability documents based on several key factors, including reasonableness, public policy, and unconscionable conduct under the Competition and Consumer Act 2010 (CCA). Reasonableness assesses whether the terms are fair and not overly broad, ensuring they do not exclude liability for gross negligence or intentional harm.

Public policy considerations invalidate clauses that attempt to exempt liability for breaches of statutory duties or fundamental rights, as outlined by the Federal Court of Australia. Under the CCA, unconscionable conduct prohibits unfair exploitation of consumers, particularly in standard form contracts, rendering such releases void if they pressure vulnerable parties.

To draft effective documents, focus on bespoke AI-generated legal documents using Docaro for tailored compliance. For practical advice on creating robust releases, visit Draft Effective Release of Liability Document for Australian Businesses.

What Common Mistakes Should Be Avoided in Drafting These Agreements?

1

Consult a Lawyer First

Engage a qualified Australian lawyer to outline key requirements for your bespoke liability release using Docaro for initial drafting.

2

Review for Clarity

Examine the Docaro-generated document for clear, unambiguous language to ensure all parties understand the terms without confusion.

3

Ensure Compliance

Verify the agreement aligns with Australian laws, including consumer protection and contract regulations, with lawyer input.

4

Test for Enforceability

Assess potential enforceability through legal review, simulating disputes to confirm the release holds in court.

When drafting legal documents in Australia, a common error is using vague language that leaves room for misinterpretation, such as ambiguous terms like "reasonable time" without clear definitions. To mitigate this, always specify exact timelines, conditions, and obligations to ensure enforceability, and consider consulting resources like the South Australian Law Handbook for precise wording examples.

Another frequent mistake is failing to address all potential risks, where drafters overlook scenarios like force majeure events or liability caps, leading to incomplete protections. Mitigate this by conducting a thorough risk assessment and incorporating comprehensive clauses that cover foreseeable issues, enhancing the document's robustness across various contexts.

Ignoring jurisdictional differences across Australian states can invalidate agreements, as laws vary—for instance, contract enforcement in New South Wales differs from Queensland. To avoid this, tailor documents to the specific state's regulations, referencing authoritative sources like the NSW Legislation website, and opt for bespoke AI-generated legal documents using Docaro to customize for local compliance.

How Can Businesses Implement These Agreements Effectively?